Tax h(e)avens

What exactly do you want?

Up up and away?

Before you bother yourself, read our research results of recent years (and decades):

Not supernatural, but at least "transoceanic":

Banking

Doing banking, invisible to (foreign) authorities and information services. Billing your business where it will not (once again) be charged. If you are credible enough not to be suspected of being a drug trafficker, money launderer or terrorist financier, you will spend less formalities than you think to become a respected and accepted partner of a bank and your clients outside your home country.

Incorporating

In principle, no company is too small not to run a branch in a country that does not cause you excessive (tax) pain on the passive side. To find out how best to remain a foreign company from your home states by placing yourself under the protection of your new host country, read our special reports here

Residency / Citizenship

Even if the thought of it is difficult, perhaps even unbearable for you: The only sure way to escape all hardships is: Leave completely, with your person and with your money the sphere of influence of domestic laws. At least as far as you are at home as an income and tax-exempt. They are completely and for all time "off the hook". A second pass works wonders here. To become such a "world citizen" of the special kind, however, needs time but money. This is where the national pride of your new benefactors comes to the fore. How to prove to you that you want to belong to you, we show you in our report "Relocation", which you can request at the bottom of this page.

USA

If you have no other specific reasons to favor a particular US state, there are currently only three states that meet your needs:

New York

"Startup NYC" is the name of the new initiative of the state of New York. If you are not opening another law firm or dental practice, or even wanting to penetrate the financial world of the city, but are tapping into a productive, forward-thinking, creative business, all doors open for you: start a marketing company, bring in new ideas the IT market, or control the logistics of internationally operating businesses: Welcome to one of New York's new free-trade centers.

With a guaranteed tax exemption in the first 10 years. → StartupNYC

Delaware

If the former American President (Obama) bleats about a house (in Delaware) with 200,000 companies in it, and calls this a fraud on his own doorstep, he is wrong.

When service and administration of a company are separated, this corresponds to the realities of the global economy. Every second Wall Street listed corporation is registered in Delaware. And documents need less space than a truck fleet.

For example, there is only one thin folder in the "Ugland House" (Administration building in Wilmington) for Google or YouTube. All these companies are administrated by a few dozen lawyers.

The facts that the first US state Delaware is still offering itself as your second (corporate) home, can be found in our current → Special Report.

Nevada

10 years tax exemption in New York is not enough for your needs? Or you bring no business idea that is "eligible" enough to enjoy these benefits? Or are the 6% Delaware flat tax too much for you?

Then, at least on paper, it's best for you

to move into the Nevada desert. In the player's paradise, you pay

no taxes. But you should ensure sales. For the petty "paperwork", local lawyers and notaries

want to be lavishly rewarded,

so that you should deposit amounts that outweigh these costs.

Our experience will help you to make it profitable for you to

move here.

BERMUDAS

The Bermudas lie in the Atlantic, but are similar to Caribbean tax havens. Thus, they demand neither income tax nor corporation tax, the state revenue comes mainly from social security contributions for companies and import duties. Nevertheless, the Bermudas, especially for "newcomers", such as the Caymans, are no longer recommended, because the willingness to cooperate with investigators overseas is growing - banking secrecy or not. The Bermudas have signed an agreement on the exchange of tax information with Great Britain; the first of its kind with an EU state; UK Treasury Secretary Jane Kennedy celebrates "an important step in the fight against tax evasion". Similar agreements with other countries could follow soon. Behind the scenes, the negotiations are in full swing.

In short: Not recommended.

South AMERIKA

Argentina

We are currently viewing extensive new material. If we can (still) make a recommendation, we will inform you here.

Brasil

Weather BRICS was a stillbirth is currently (still) uncertain. Like so many in South American countries, the inhabitants of their mentality are more inclined to indulge in communist promises than those of (most) developed countries. The trade deficit is enormous, the country's political future more than uncertain. If Brazil can not escape its proletariat soon, the country faces an economic and political catastrophe. Not the first of this hopeful country. If you have no really good reasons to relocate there, wait and see what direction the country drifts. As a tax haven and safe haven for assets: currently discouraged!

Chile

In the opinion of most experts for "Strategic Relocation", Chile is currently still the first choice among all South American countries. As a retreat for retired politicians as popular as for submerged drug barons, it gradually loses its appeal for "normal" emigrants. We agree only to a limited extent, because it is not clear what "residual" power the former political / criminal figures still have in their exile. However, since Pinochet's day, things seem to have improved in terms of Chile's internal peace. But those who have the misfortune to move their new domicile just in the vicinity of his former enemies, could have difficulties if one does not follow the principle of "neutral ground". However, so far no such rule violations have become known, and the country offers enough space for all, as far as territorial limited to "normal" land sizes. Otherwise, as everywhere in South America: watch out!

Panama

Capital is a shy deer. The talked-about country still has too much unwanted attention in public.

Positive: The hitherto outrageously high prices e. g. for start-ups seem to decline due to lack of demand.

Although the banking business suffers from the outflow of capital, improvements in the conditions are not to be expected. We are currently viewing extensive new material. If we can (again) make a recommendation, we will inform you about this at this point.

Paraguay

There are many indications that during the European Civil War, due to pressure from the Brussels special decrees (to avoid the word "martial law"), a ban on leaving the country at least temporarily will be issued. In contrast to other cumbersome legislation, this may very quickly happen because of long-term contracts; literally overnight. So if you do not want to wait until you can travel again, when you do not need it anymore, you have arrived in one of the safest places in the world in Paraguay. After the previous, failed communist experiments, nature remained relatively intact, making Paraguay the third largest water reservoir in the world. And after gold, water is the most valuable raw material of the future. (See business section.)

We would be happy to send you more up-to-date information on → request gerne nähere tappensienichte Informationen zu.

Uruguay

Until recently, Uruguay was basically the same as Paraguay. However, since June 2016, the country has a new, powerful president who has nothing in common with the old one, who has been internationally recognized as "the poorest president in the world".

Tabaré Vázquez not only has the full support of his people (other Latin American countries, especially the big ones, are currently governed only by tiny majorities),

Vázquez also enjoys the confidence of international big business, thanks to almost zero interest rates in the western industrialized countries so far has lured more than 9 billion investment capital into the country.

Atlantic area

Cayman Islands

Tax exemption especially for investment companies. From the capital Georgetown operate numerous financial investors and hedge funds. In competition with other tax havens, the government of Prime Minister Kurt Tibbetts wants to further relax the rules for such investors. For smaller fortunes, however, the state provides less and less protection under pressure from Britain and the US. The events of recent years speak for themselves.

Therefore our summary: Out. At least until the islands are safer again.

Bahamas

Somehow better. "You get what you pay for". And that costs. That's the motto in the Bahamas:

"If you don' t have money, don't come!"

And at least they are honest enough to admit what they are interested in first and foremost. However, they are then ready to give you all the benefits you are looking for. If it does not cost them anything. And if you are ready to pay for it.

Prime Minister Hubert Ingraham recently assured that there will be "no new taxes". In the face of high budget deficits speculation had become loud, also in the Bahamas there would be an income tax in the future. However, existing taxes such as the land transfer tax will in future be driven more decisively and "loopholes closed".

"Bahamas citizens", according to Zhivargo (Bahamian economic consultant), "know too little about their tax obligations". Whatever that means. Nothing new for German ears.

Consequently, here too in the future: "Fox, watch out!"

Caribbean

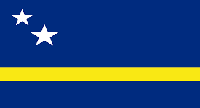

Netherlands Antilles (Aruba, Curacao, Bonaire)

Anyone who is at least 50 years old, buys a property for $ 230,000 or more and employs a domestic worker for 30 hours a week, instead of paying a progressive income tax rate of currently 39 percent, only has to pay a flat rate of 10 percent to the Treasury.

In addition, Dutch law applies. Who does not shy away from being close to the local tax authorities: politically stable, socially secure. Otherwise only partially recommended. Freedom has its price, safety too.

Anguilla

The island to the east of Puerto Rico charges neither income tax nor corporation tax.

Anguilla is particularly attractive for entrepreneurs who can start a business there quickly, easily and inexpensively. Then: nothing like gone. Longer stays lead to boredom. God save the Queen!

Antigua and Barbuda

Here, foreign entrepreneurs can negotiate exemption from tax for up to 15 years ("tax holiday"). There is no personal income tax, but foreigners have to pay $ 20,000 a year to live.

For average income too expensive.

British Virgin Islands

The British overseas territory had to resemble Cayman's massive international pressure bow down and abolish previous benefits for offshore companies - but has since 2004 progressively cut income and corporate tax for all.

St. Kitts and Nevis

The corporation tax on the volcanic island is considerable at 35 percent, but offshore companies are usually tax-exempt.

There is no income tax, but earners pay social security contributions of up to ten percent.

St. Vincent and the Grenadines

Tax exemptions of up to 25 years for foreign companies have attracted a number of entrepreneurs.

Private individuals pay tax rates of 10 to 40 percent. The top rate should, however, gradually drop to 30 percent.

Turks- und Caicos-Isles

The British territory, which includes 30 islands, enjoys a high degree of autonomy. There is no income tax or corporation tax, however, with interest income from savers from EU countries, the EU interest tax of 15 percent is due.

If you want to move to the islands, you have to invest at least $ 125,000 there.

US virgin islands

The US-owned archipelago, two-thirds of which is inhabited by Americans, has some privileges for offshore companies.

Otherwise, however, US tax rules apply. The mother country is wary of the tax benefits not getting out of hand.

Dominican Republic

Last but not least a recommendation for all tax-tired 'self-preservatives' and 'self-retainers':

Even before Paraguay and

Uruguay one of our current priorities. No other country in the Caribbean offers you such advantages as this one. Especially in the near future attractive special regulations apply (like 10 years tax exemption for new branches).

New, highly attractive new laws and regulations that made it worthwhile to create your own documentation.

We will send them to you gladly on →

request.

Stay at home?

Pardon?

That really can not be serious.

At a minimum, you should show everyone who decides whereto hold and what to do with your money, giving it at least a second home, far from the pursuits of local collectors. (Should you prefer for yourself, to stay at home).

Let it work, "remote controlled", in paradise (You can visit it from time to time.)

Strategic Relocation

This word is so new in Europe for many that it has not been translated yet. However, experts and the so-called "preprovers" have long since become the often scary term.

We do not want to go into these discussions at this point, but point out that, despite everything:

"It never gets as well as you hoped,

but never as bad as you think!"

In any case, you should first find out about the legal alternatives that are available nowadays.

More detailed information about the countries mentioned, we will gladly send you on request: Relocation