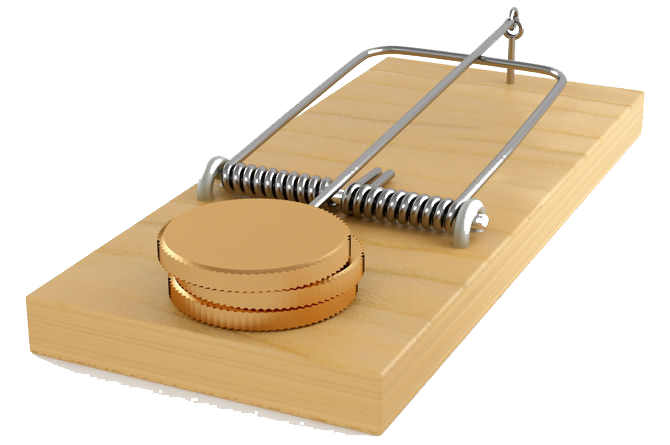

Don't fall into the Gold Trap

One thing is certain:

Nobody will come

to help you.

That's for sure.

The (last) banking crisis alone (from 2007) has, roughly estimated, driven 100 million people (back) into poverty. Governments don't run the world. Goldman Sachs and a few other systems rule the world. For example, For example, the Greek President Papademus was not elected by the people, but rather installed. During his time as governor of the Greek central bank, he was responsible, among other things, for the transition from the drachma to the euro. Mario Draghi, a Goldman Sachs man, president of the ECB and governor of the Italian state bank, actively helped him conceal the national debt. - These people are just everywhere. - If you want to change the current financial system, it would be like trying to piss against the wind.

The (last) banking crisis alone (from 2007) has, roughly estimated, driven 100 million people (back) into poverty. Governments don't run the world. Goldman Sachs and a few other systems rule the world. For example, For example, the Greek President Papademus was not elected by the people, but rather installed. During his time as governor of the Greek central bank, he was responsible, among other things, for the transition from the drachma to the euro. Mario Draghi, a Goldman Sachs man, president of the ECB and governor of the Italian state bank, actively helped him conceal the national debt. - These people are just everywhere. - If you want to change the current financial system, it would be like trying to piss against the wind.

Debt-based money ensures that for every euro that is earned, there are at least 3 more euros of debt . This debt ends up with the lower middle class, where else? - These people are sitting on a mountain of debt, the interest from which flows back into the banking system.

After the "Nixon shock" of August 15, 1971, when American President Nixon abandoned the gold standard,

the seniority of the dollar's intrinsic value rose to absurd levels, thanks to the running printing presses. The fundamental problem was that the USA wanted to achieve too many goals, some of which contradicted each other. They strived for an independent monetary policy that was not dependent on foreign countries. It is inherently unstable.

the seniority of the dollar's intrinsic value rose to absurd levels, thanks to the running printing presses. The fundamental problem was that the USA wanted to achieve too many goals, some of which contradicted each other. They strived for an independent monetary policy that was not dependent on foreign countries. It is inherently unstable.

What happened in a similar form during the Cyprus crisis showed:In 2013, not so long ago, when the Cypriot government could no longer meet its obligations because it was downgraded to junk status by international rating agencies, the bank's customers were used ( of Cyprus). With a whopping 47.5% compulsory levy! Basically in return for the ten billion euros in aid from the EU and the International Monetary Fund (IMF). (The banks of the island republic had, among other things, massively speculated on Greek government bonds.) Of course, the money went to the banks, not to their customers.

As you can read elsewhere in this publication, Gold is a "Stress Material". So:

Do not pat in the Gold-Trap!

No other investment product is currently being advertised as massively as the inedible precious metal. That should give you thinking. If you do not appreciate it as a piece of jewelry, it makes little sense to wait for it to grow in its safe. It does not grow, and neither bars nor coins are suitable as a fungible means of payment in times of need. Unless in credit card format with predetermined breaking points of 1g each:

But apart from the fact that you will have problems with the baker or butcher when it comes to billing, it may be (as has happened before) that private possession of gold will be punishable anyway. But that brings us to the area of expertise of “preppers”. But more about that elsewhere.