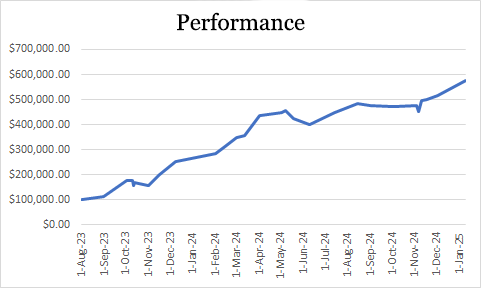

Unfortunately, we only started running a "sample depot" (upon request) in August '23;

i. e. we started with a fictitious amount of $100,000.00 to visually represent our performance.

Of course, with the awareness that this can only be an approximate value of your investment, as many individual factors come into play, such as: E.g. willingness to take risks, preferences, etc.

Furthermore, going back to 1998 would only create resentment, since with everything we expect in the next few years, this performance can increase exponentially.

As you know, past successes are no guarantee for the future: so prepare to be surprised!

Despite all modesty, we feel that we and our team, encouraged by these past successes, are able to take on and surpass even the greatest investors in the world, such as Warren Buffett and Charlie Munger; at least in the area of stocks.

Why are we so sure about this?

- Because we use our "emotional intelligence" to achieve these successes - but that's another topic (which we'll talk about in more detail elsewhere...).

|

1 |

4 |

3 |

3 |

Blackstone Group |

New York City,  Vereinigte

Staaten Vereinigte

Staaten |

$82.851 |

|

2 |

1 |

1 |

2 |

Carlyle Group |

Washington, D.C.,  Vereinigte

Staaten Vereinigte

Staaten |

$63.802 |

|

3 |

3 |

2 |

4 |

Kohlberg Kravis Roberts |

New York City,  Vereinigte

Staaten Vereinigte

Staaten |

$47.977 |

|

4 |

6 |

6 |

10 |

CVC Capital Partners |

Luxemburg,  Luxemburg Luxemburg |

$47.413 |

|

5 |

9 |

14 |

5 |

Warburg Pincus |

New York City,  Vereinigte

Staaten Vereinigte

Staaten |

$36.557 |

|

6 |

10 |

21 |

9 |

Bain Capital |

Boston,  Vereinigte

Staaten Vereinigte

Staaten |

$35.554 |

|

7 |

18 |

26 |

40 |

EQT Partners |

Stockholm,  Schweden Schweden |

$30.054 |

|

8 |

32 |

|

|

Thoma Bravo |

Chicago,  Vereinigte

Staaten Vereinigte

Staaten |

$29.880 |

|

9 |

5 |

4 |

8 |

Apollo Global Management |

New York City,  Vereinigte

Staaten Vereinigte

Staaten |

$29.001 |

|

10 |

23 |

|

|

Neuberger Berman |

New York City,  Vereinigte

Staaten Vereinigte

Staaten |

$28.884 |

|

11 |

14 |

22 |

22 |

Hellman & Friedman |

San Francisco,  Vereinigte

Staaten Vereinigte

Staaten |

$26.900 |

|

12 |

2 |

5 |

1 |

Texas Pacific Group |

Fort Worth,  Vereinigte

Staaten Vereinigte

Staaten |

$25.661 |

|

13 |

7 |

11 |

16 |

EnCap Investments |

Houston,  Vereinigte

Staaten Vereinigte

Staaten |

$21.097 |

|

14 |

11 |

48 |

59 |

Vista Equity Partners |

San Francisco,  Vereinigte

Staaten Vereinigte

Staaten |

$19.785 |

|

15 |

34 |

29 |

52 |

Apax Partners |

London, .svg.png) Vereinigtes

Königreich Vereinigtes

Königreich |

$18.615 |

|

16 |

28 |

7 |

12 |

General Atlantic |

Greenwich (Connecticut),  Vereinigte

Staaten Vereinigte

Staaten |

$16.916 |

|

17 |

27 |

9 |

33 |

Clayton, Dubilier & Rice |

New York City,  Vereinigte

Staaten Vereinigte

Staaten |

$16.509 |

|

18 |

17 |

36 |

|

Permira |

London, .svg.png) Vereinigtes

Königreich Vereinigtes

Königreich |

$16.394 |

|

19 |

8 |

10 |

7 |

Advent International |

Boston,  Vereinigte

Staaten Vereinigte

Staaten |

$16.026 |

|

20 |

13 |

15 |

27 |

Silver Lake |

Menlo Park,  Vereinigte

Staaten Vereinigte

Staaten |

$15.000 |

|

21 |

12 |

|

|

Partners Group |

Baar ZG,  Schweiz Schweiz |

$14.726 |

|

22 |

24 |

23 |

81 |

Stone Point Capital |

Greenwich (Connecticut),  Vereinigte

Staaten Vereinigte

Staaten |

$14.544 |

|

23 |

37 |

|

|

Bridgepoint |

London, .svg.png) Vereinigtes

Königreich Vereinigtes

Königreich |

$14.264 |

|

24 |

|

|

|

Brookfield Asset Management |

Toronto, .svg.png) Kanada Kanada |

$14.197 |

|

25 |

31 |

18 |

43 |

Onex Corporation |

Toronto, .svg.png) Kanada Kanada |

$14.106 |

|

26 |

26 |

24 |

23 |

BC Partners |

London, .svg.png) Vereinigtes

Königreich Vereinigtes

Königreich |

$13.275 |

|

27 |

|

|

|

Genstar Capital |

San Francisco,  Vereinigte

Staaten Vereinigte

Staaten |

$13.100 |

|

28 |

|

|

|

PAI partners |

Paris, .svg.png) Frankreich Frankreich |

$13.061 |

|

29 |

|

|

|

Hillhouse Capital Group |

Peking,  Volksrepublik

China Volksrepublik

China |

$12.725 |

|

30 |

47 |

39 |

39 |

Leonard Green & Partners |

Los Angeles,  Vereinigte

Staaten Vereinigte

Staaten |

$12.238 |

|

31 |

35 |

|

|

Insight Venture Partners |

New York,  Vereinigte

Staaten Vereinigte

Staaten |

$12.236 |

|

32 |

25 |

|

|

American Securities Capital Partners |

New York,  Vereinigte

Staaten Vereinigte

Staaten |

$12.000 |

|

33 |

44 |

|

|

Baring Private Equity Asia |

Hongkong Hongkong |

$11.833 |

|

34 |

29 |

27 |

30 |

Cinven |

London, .svg.png) Vereinigtes

Königreich Vereinigtes

Königreich |

$11.548 |

|

35 |

19 |

|

|

NGP Energy Capital Management |

Irving,  Vereinigte

Staaten Vereinigte

Staaten |

$11.355 |

|

36 |

|

19 |

29 |

Ardian (AXA Private Equity) |

Paris, .svg.png) Frankreich Frankreich |

$10.975 |

|

37 |

|

|

|

New Mountain Capital |

New York City,  Vereinigte

Staaten Vereinigte

Staaten |

$10.585 |

|

38 |

21 |

12 |

6 |

Goldman Sachs Merchant Banking Division |

New York City,  Vereinigte

Staaten Vereinigte

Staaten |

$10.500 |

|

39 |

41 |

|

|

Tiger Global Management |

New York City,  Vereinigte

Staaten Vereinigte

Staaten |

$10.250 |

|

40 |

|

|

|

Quantum Energy Partners |

Houston,  Vereinigte

Staaten Vereinigte

Staaten |

$10.040 |

|

41 |

|

|

|

Pacific Alliance Group |

Hongkong Hongkong |

$9.950 |

|

42 |

20 |

16 |

11 |

Riverstone Holdings |

New York City,  Vereinigte

Staaten Vereinigte

Staaten |

$9.904 |

|

43 |

|

|

|

L Catterton |

Greenwich (Connecticut),  Vereinigte

Staaten Vereinigte

Staaten |

$9.838 |

|

44 |

|

|

|

Affinity Equity Partners |

Hongkong Hongkong |

$9.800 |

|

45 |

|

|

|

HarbourVest Partners |

Boston,  Vereinigte

Staaten Vereinigte

Staaten |

$9.599 |

|

46 |

39 |

33 |

101 |

GTCR Golder Rauner |

Chicago,  Vereinigte

Staaten Vereinigte

Staaten |

$9.100 |

|

47 |

|

|

|

Roark Capital Group |

Atlanta,  Vereinigte

Staaten Vereinigte

Staaten |

$9.000 |

|

48 |

|

|

|

Eurazeo |

Paris, .svg.png) Frankreich Frankreich |

$8.956 |

|

49 |

22 |

8 |

18 |

Ares Management |

Los Angeles,  Vereinigte

Staaten Vereinigte

Staaten |

$8.650 |

|

50 |

|

|

|

Adams Street Partners |

Chicago,  Vereinigte

Staaten Vereinigte

Staaten |

$8.498 |

|

|

15 |

|

|

Centerbridge Capital Partners |

New York City,  Vereinigte

Staaten Vereinigte

Staaten |

|

|

|

16 |

37 |

50 |

Energy Capital Partners |

Short Hills (New Jersey),  Vereinigte

Staaten Vereinigte

Staaten |

|

|

|

30 |

32 |

|

Russian Direct Investment Fund (RDIF) |

Moskau,  Russland Russland |

|

|

|

33 |

35 |

90 |

HgCapital |

London, .svg.png) Vereinigtes

Königreich Vereinigtes

Königreich |

|

|

|

36 |

30 |

57 |

Triton Partners |

Frankfurt am Main,  Deutschland Deutschland |

|

|

|

38 |

|

|

BDT Capital Partners |

Chicago,  Vereinigte

Staaten Vereinigte

Staaten |

|

|

|

40 |

|

|

Pamplona Capital Management |

London, .svg.png) Vereinigtes

Königreich Vereinigtes

Königreich |

|

|

|

42 |

34 |

51 |

Welsh Carson Anderson & Stowe |

New York City,  Vereinigte

Staaten Vereinigte

Staaten |

|

|

|

43 |

43 |

48 |

RRJ Capital |

Hongkong Hongkong |

|

|

|

45 |

47 |

44 |

Sequoia Capital |

Menlo Park,  Vereinigte

Staaten Vereinigte

Staaten |

|

|

|

46 |

|

|

Energy & Minerals Group (EMG) |

Houston,  Vereinigte

Staaten Vereinigte

Staaten |

|

|

|

48 |

17 |

14 |

Oaktree Capital Management |

Los Angeles,  Vereinigte

Staaten Vereinigte

Staaten |

|

|

|

49 |

|

|

Abraaj Group |

Dubai,  Vereinigte

Arabische Emirate Vereinigte

Arabische Emirate |

|

|

|

50 |

40 |

|

Georgian Co-investment Fund (GCF) |

Tiflis,  Georgien Georgien |

|

|

|

|

13 |

53 |

EIG Global Energy Partners |

Washington, D.C.,  Vereinigte

Staaten Vereinigte

Staaten |

|

|

|

|

20 |

15 |

Lone Star Funds |

Dallas,  Vereinigte

Staaten Vereinigte

Staaten |

|

|

|

|

25 |

13 |

JP Morgan Asset Management |

New York City,  Vereinigte

Staaten Vereinigte

Staaten |

|

|

|

|

28 |

31 |

Mount Kellett Capital |

New York City,  Vereinigte

Staaten Vereinigte

Staaten |

|

|

|

|

31 |

36 |

Cerberus Capital Management |

New York City,  Vereinigte

Staaten Vereinigte

Staaten |

|

|

|

|

38 |

25 |

Nordic Capital |

Stockholm,  Schweden Schweden |

|

|

|

|

41 |

46 |

TA Associates |

Boston,  Vereinigte

Staaten Vereinigte

Staaten |

|

|

|

|

42 |

28 |

American Capital |

Bethesda (Maryland),  Vereinigte

Staaten Vereinigte

Staaten |

|

|

|

|

44 |

202 |

Pine Brook Road Partners |

New York City,  Vereinigte

Staaten Vereinigte

Staaten |

|

|

|

|

45 |

62 |

Charterhouse Capital Partners |

London, .svg.png) Vereinigtes

Königreich Vereinigtes

Königreich |

|

|

|

|

46 |

35 |

CDH Investments |

Hongkong Hongkong |

|

|

|

|

49 |

67 |

AlpInvest Partners |

Amsterdam,  Niederlande Niederlande |

|

|

|

|

50 |

102 |

MBK Partners |

Seoul,  Südkorea Südkorea |

- Apart from the fact that they hardly make their business internals available to the public.

- Modest as we are, we don't take transparency too seriously and even "brag" about how we achieve our achievements. So if you want to see in detail how the above chart comes to be (and came to be), take a few minutes and check for yourself. You'll notice that we also only cook with water; But the content of the resulting soup is crucial for its taste: ->

Sample Depot