Barrick Gold Corporation

Company Profile

Barrick Gold Corporation engages in the exploration and development of mineral properties.

It primarily explores for gold and copper deposits. The company holds a 50% interest in the Veladero mine located in the San Juan Province of Argentina;

50% interest in the KCGM, a gold mine located in Australia; 95% interest in Porgera, a gold mine located in Papua New Guinea;

50% interest in the Zaldívar, a copper mine located in Chile; and 50% interest in the Jabal Sayid, a copper mine located in Saudi Arabia.

It also owns gold mines and exploration properties in Africa; and gold projects located in South America and North America.

Barrick Gold Corporation was founded in 1983 and is headquartered in Toronto, Canada.

Barrick Gold Corporation engages in the exploration and development of mineral properties.

It primarily explores for gold and copper deposits. The company holds a 50% interest in the Veladero mine located in the San Juan Province of Argentina;

50% interest in the KCGM, a gold mine located in Australia; 95% interest in Porgera, a gold mine located in Papua New Guinea;

50% interest in the Zaldívar, a copper mine located in Chile; and 50% interest in the Jabal Sayid, a copper mine located in Saudi Arabia.

It also owns gold mines and exploration properties in Africa; and gold projects located in South America and North America.

Barrick Gold Corporation was founded in 1983 and is headquartered in Toronto, Canada.

The first own winding tower stood in Renabie, Ontario, 1983 took over Barrick Gold Corporation in half Renabie, a gold mine in northern Ontario. Shortly thereafter, Barrick debuted on the Toronto Stock Exchange. Barrick's strategy was to grow by acquiring existing gold properties and focusing on high-quality, profitable ounces. Largest deal in 2001 was the acquisition of one of the then largest Wall Street traded mining companies, Homestake Mining Corp. As part of this all-embracing plan to strengthen the company, Barrick has become a lean, agile organization better protected than others against the downside gold price risk and positioned well enough to offer attractive future investment opportunities over the gold price.

As part of this all-encompassing plan to strengthen the company, Barrick has become a lean, agile organization better protected than others against the downside gold price risk and positioned well enough to offer attractive future investment opportunities over the gold price.

The company's vision is to "generate" wealth through responsible, environmentally sound mining: wealth for the owners,

the peoples and the countries with whom partnerships are maintained.

"We want to be a leading mining company focused on gold, growing our cash flow per share

by developing and operating high quality assets through disciplined allocation of human and financial

capital and operational excellence,"

said company founder and CEO Peter Munk.

The company has returned to its roots today as a lean and agile organization with minimal bureaucracy. A relatively small head office directs the company, which is now limited to just a few core activities: defining and implementing the strategy, sharing human and financial capital, and fulfilling the commitments made by a public company, which is often suspiciously watched by Wall Street observers. Employees at the operational

level have greater autonomy and accountability towards the company than in comparable companies.

Barrick has mining operations in Argentina, Australia, Canada, Chile, the Dominican Republic, Papua New Guinea, Peru, Zambia Saudi Arabia, and the United States.

More than 75 percent of the company's gold production comes from the Americas region.

The new filet Barricks, Pueblo Viecho, located in the Dominican Republic, approximately 100 kilometers northwest of the capital Santo Domingo, is operated by the Pueblo Viejo Dominicana Corporation (PVDC) - a joint venture between Barrick (60%) and Goldcorp (40%). ). The mine has been producing since 2014 and is today the only mine in the world with an annual production of more than one million ounces of gold (100% basis), at all-in-all costs currently $ 720-740 per ounce over the next three years (2015-2017). Technical experts Barricks have identified several ways to further optimize cash flow. These include: Increasing plant throughput by optimizing ore blending and the autoclave capability of the material, as well as further reducing costs by optimizing maintenance programs.

The new capital allocation approach ensures that all new investments are strategically aligned to maximize free cash flow, in pursuit of the goal of industry-leading returns.

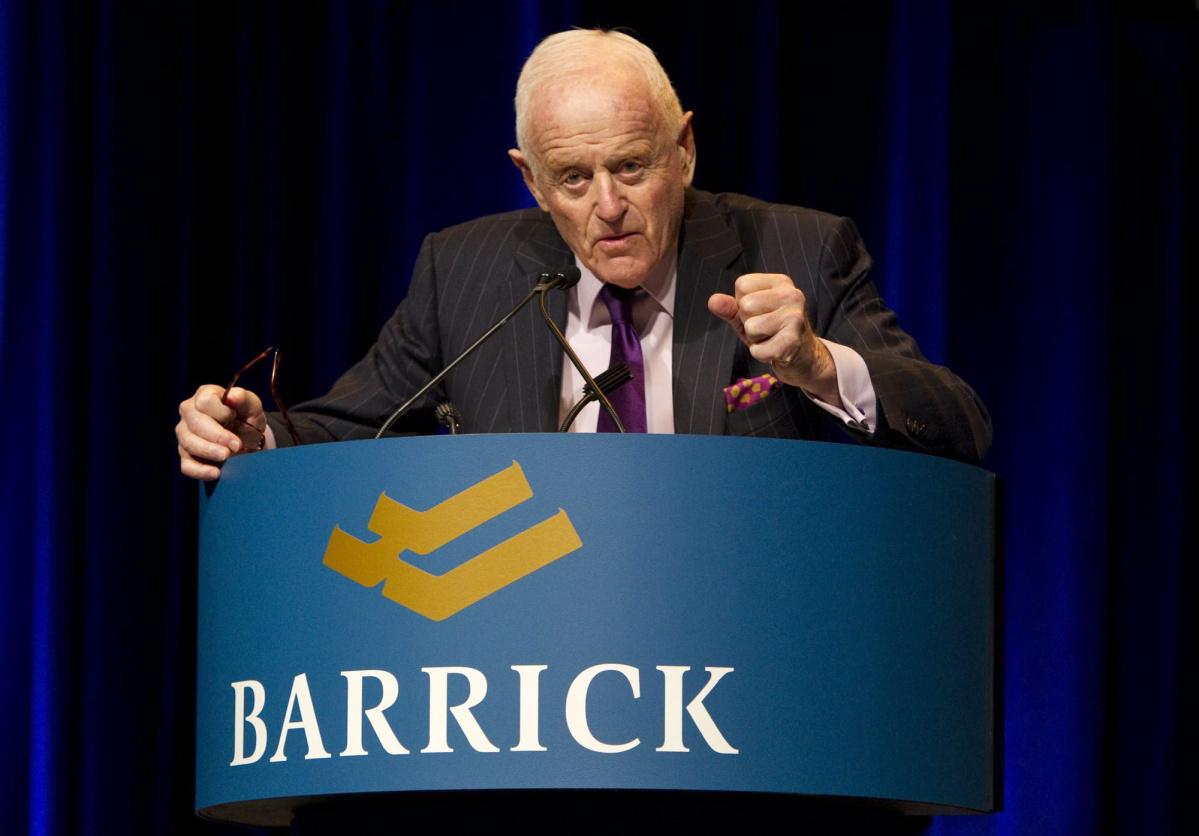

"The focus is on gold - there are no plans to diversify into other metals, or to add more to existing copper positions." says Peter Munk, "Chairman Emeritus" of the company. [see profile right]

That means creating quality, long-lasting assets in attractive countries. It expects a 10 to 15 percent return on invested capital, not least as a result of the current inflation-prone metal price cycle; Each individual project is rated against the expected minimum return of 15 percent. Projects that can not achieve this goal will be moved, deleted, or sold in the future. Over time, investments in new projects will be realized through acquisitions and share buybacks with the aim of providing a competitive dividend to the owners.

In Canada mainly day mining is ope-

rated.

Modern underground mining in the Caribbean.

Free of bureaucracy and middle management, they should focus on maximizing free cash flow.

"DISCIPLINED CAPITAL ALLOCATION"

GOLD OF THE CARIBBEAN

Documentation: Pueblo Viejo, Dominican Republic (english subtitles)

in memoriam: Peter Munk

Peter Munk was Founder and Chairman Emeritus of Barrick Gold Corporation. Today, Barrick is one of the world's largest gold mining companies, and one of Canada's leading global companies. Under Munk's leadership, Barrick grew rapidly, reaching an industry-leading position in just 25 years. Mr. Munk studied electrical engineering at the University of Toronto until 1952 in Toronto, Canada, where he spent most of his life. His entrepreneurial spirit combined with conservative financial management and strong technical know-how are core elements of the company's "DNA". As a leader and philanthropist, Peter Munk supported a number of charitable organizations. He supported world-class education in the countries in which Barrick is active and makes an enormous

contribution to improving health facilities and public order.

These include u. a. the funding of a leading center for international studies at the Munk School of Global Affairs at the University of Toronto, the Peter Munk Heart Center in Toronto, and the Center for Research, Innovation and Technology at the Technion University in Israel. Peter Munk was an officer of the Order of Canada in 1993 and was promoted to Companion of the Order of Canada in 2009 with the country's highest civilian award.

In 2002, he received the Woodrow Wilson Award for Corporate Citizenship, becoming the first Canadian to receive this prestigious award. Peter Munk is a member of both the Canadian Mining Hall of Fame and the Canadian Business Hall of Fame and a recipient of the Queen Elizabeth II Diamond Jubilee Medal in 2012.

Expectantly

Barrick Gold Corporation (NYSE:ABX)

remains an absolute buy, if not a future, outperformer even after the turnaround. Whatever the current economic situation is; Almost all mines are currently curbing their mining activities after the gold cycle has passed the upper inflection point. The associated price loss of the share, the company hardly bothers, because the net asset value so nothing changes and also gives the opportunity to buy back own shares from the market.

Whatever the current economic situation is; Almost all mines are currently curbing their mining activities after the gold cycle has passed the upper inflection point. The associated price loss of the stock, the company hardly bothers, since the net asset value so nothing changes and also gives the opportunity to buy back own shares from the market.

Current quote: → Markets > Stocks > Barrick Gold Corporation

More facts worth knowing and extensive material are available directly from

→ Barrick Gold Corporation